All about Hard Money Georgia

Wiki Article

The 2-Minute Rule for Hard Money Georgia

Table of ContentsUnknown Facts About Hard Money Georgia6 Simple Techniques For Hard Money GeorgiaWhat Does Hard Money Georgia Do?The Definitive Guide to Hard Money GeorgiaSome Known Facts About Hard Money Georgia.The Definitive Guide for Hard Money Georgia

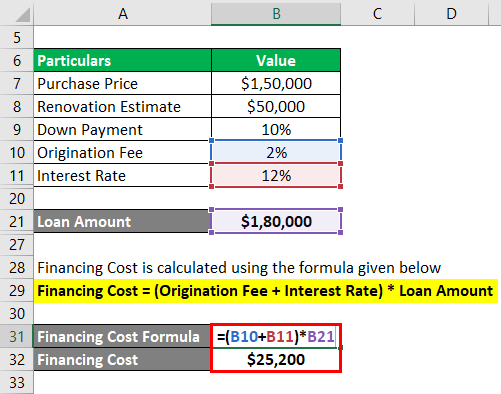

Given that hard money lendings are collateral based, additionally referred to as asset-based finances, they require minimal paperwork and also permit capitalists to close in an issue of days - hard money georgia. Nonetheless, these fundings come with more danger to the lending institution, as well as for that reason call for greater deposits and also have greater rate of interest than a conventional financing.Along with the above malfunction, tough money car loans as well as traditional mortgages have various other distinctions that distinguish them in the minds of financiers as well as loan providers alike: Tough cash loans are moneyed faster. Many conventional car loans may take one to 2 months to shut, yet difficult cash finances can be shut in a few days.

Standard home loans, in contrast, have 15 or 30-year payment terms on standard - hard money georgia. Difficult cash loans have high-interest prices. Many tough money car loan interest rates are anywhere in between 9% to 15%, which is considerably greater than the interest price you can expect for a conventional mortgage.

Not known Details About Hard Money Georgia

Once the term sheet is signed, the lending will certainly be sent to processing. During loan processing, the loan provider will request records and prepare the financing for last loan review as well as timetable the closing.

The Ultimate Guide To Hard Money Georgia

Common departure techniques include: Refinancing Sale of the property Payout from other source There are numerous scenarios where it may be beneficial to utilize a tough money car loan. For starters, investor who like to house flip that is, acquire a review home in requirement of a great deal of More Help work, do the work directly or with contractors to make it better, then transform about and sell it for a higher rate than they got for may locate tough cash financings to be suitable funding choices.

Due to this, specialist residence fins normally like temporary, fast-paced funding solutions. In addition to that, home fins generally attempt to market residences within less than a year of acquiring them. Because of this, they do not require a long term as well as can stay you can try this out clear of paying excessive passion. If you buy investment properties, such as rental buildings, you might likewise find hard money loans to be excellent options.

In some instances, you can also use a hard money lending to buy uninhabited land. Note that, also in the above circumstances, the possible downsides of tough money car loans still apply.

Unknown Facts About Hard Money Georgia

While these kinds of car loans might seem difficult and also challenging, they are a commonly utilized financing approach several genuine click to read more estate investors use. What are hard cash finances, as well as exactly how do they function?Hard money loans normally come with greater interest rates as well as much shorter settlement schedules. Why choose a difficult cash finance over a conventional one?

A difficult money finance might be a viable alternative if you are interested in a fixer-upper that might not qualify for standard financing. You can additionally utilize your current property holdings as collateral on a tough cash lending. Tough money lending institutions generally decrease danger by charging greater rates of interest and offering shorter repayment routines.

Some Known Facts About Hard Money Georgia.

Furthermore, due to the fact that exclusive individuals or non-institutional lenders provide tough money lendings, they are not subject to the same laws as standard lending institutions, which make them extra risky for consumers. Whether a difficult money lending is appropriate for you relies on your circumstance. Hard cash finances are excellent alternatives if you were refuted a standard funding and also require non-traditional financing., we're here to assist. Obtain started today!

The application procedure will commonly include an assessment of the residential or commercial property's worth and possibility. That way, if you can't manage your payments, the difficult cash lender will just relocate ahead with marketing the residential or commercial property to recoup its financial investment. Hard cash lending institutions usually bill greater rate of interest than you 'd carry a traditional finance, yet they likewise fund their finances quicker and typically need much less documents.

Hard Money Georgia for Beginners

Rather than having 15 to three decades to repay the lending, you'll commonly have just one to five years. Tough money car loans function rather differently than standard loans so it is very important to understand their terms as well as what deals they can be used for. Hard money loans are generally planned for investment buildings.Report this wiki page